The increased public demand for ‘climate action’ has motivated participants in many industries to establish ambitious ‘carbon’ neutrality goals. There can be confusion about exactly what this means, (for example, greenhouse gas emissions are not the same as ‘carbon’).

The essential element of any net-zero emissions goal is to reduce greenhouse gas emissions generated from the activity of the enterprise as much as possible, and then to seek emissions credits to offset the remaining emissions and balance the account.

The increased interest in achieving net-zero emissions has therefore created an increasing demand for carbon dioxide equivalent offsets – carbon credits. That demand is seeking suppliers and market opportunities are emerging.

Soils as a carbon sink

Where will the supply of credits be generated? While engineered solutions such as direct carbon capture and underground storage (CCUS) have appeal, their costs and technical constraints limit the current supply of offsets from those systems.

Photosynthesis in plants is of course nature’s own CCUS system. Plants take carbon dioxide directly from the atmosphere, convert it into stable carbohydrates, and some portion of these are translocated to roots and then into organic compounds in soil.

The potential of soils as a carbon sink has long been recognized, and with the emergent interest in generating a supply of carbon credits, the motivation to capture this potential creates market interest. As with engineered solutions, converting the potential natural capital in land systems into tradeable instruments faces technical barriers.

The measurement challenge

The natural processes involved in soil carbon accumulation are well defined, however, the capacity to accurately predict the rate of accumulation and retention in soil is less developed. The challenges of measurement and prediction are exacerbated by the features of the system itself – the scope and scale of landscape-level processes. Some of this challenge is spatial – landscapes are not uniform and homogenous, and variability in site potential, current status, and rates of change are physically challenging to capture.

Some of the challenge is proportional – the size of change required to generate a credit on an acre of land is actually quite small.

Soil carbon content is typically measured and expressed as a proportion or percentage of the soil matrix. It is a concentration – the amount of carbon present in a given mass of soil. Of course, we are interested in ‘carbon dioxide equivalents’, not carbon alone.

One unit of carbon is equivalent to 3.67 carbon dioxide equivalents; stated another way, an increase of 0.27 units of carbon in the soil is equivalent to an increase of 1 unit of carbon dioxide. While a carbon credit is one metric ton of carbon dioxide equivalents (which seems like a lot!), this is diluted in the total mass of soil contained in the area examined, for example, one acre of grazing land.

One acre of soil measured to 1-foot depth (30 cm) weighs approximately 2,000 metric tons. If measured to 1 meter, the soil mass is 3,500 metric tons. Therefore, the change in measured soil carbon to achieve 1 carbon credit per acre is 0.27/2000 or 0.014 % if measured to 30 cm, and only 0.004 % if measured to 1 meter.

Even in a relatively uniform system, detecting changes of this size can be challenging. In a variable system, detecting such changes is exponentially more difficult, and can require an overwhelming volume of samples in order to generate reliable measurements.

The market challenge

Additional challenges can be described as systemic or structural in the market system itself. While a carbon credit is in some sense a physical deliverable (it represents an actual mass of carbon, translated to a carbon dioxide equivalent), it is not portable. Therefore, the item of exchange is more like the title to the credit, not the physical material itself.

Ideally, such items are perfectly fungible – a credit generated, stored, and titled is a uniform commodity, like a gallon of milk. The development of standards that define and describe the credits and the means of identifying, validating their existence (e.g., through measurement) and method of generation, securing and transferring title on sale, and accounting for their application against a unit of emissions by the end ‘user’ of the credit (this process is usually termed ‘retirement’ of the credit) are all necessary elements of a functional marketplace. To a large degree, it is the market participants themselves that will determine the acceptability of these mechanisms.

Should you commit to a carbon accumulation contract?

Of course, the fundamental question for a landowner is whether or not they should enter this marketplace as a supplier of carbon credits generated from the land under their management. The appropriate answer to this question is contextual, but the elements of that context are contained in the challenge areas described above.

What is the potential of the combination of my landscape and management action to generate carbon credits? Can the accumulation be measured effectively? Is there a mechanism available to efficiently bring the product to market? Finally, if these questions are addressed, a manager must determine a market position – should I sell now, wait until later, or some combination? None of these are easy questions to answer.

The benefits of data collection go beyond carbon

The first areas are technical, and the rapid development of technologies to help address these challenges is encouraging. For many managers, a primary barrier is the lack of any ‘baseline’ or foundational data. Because the barriers to identifying, collecting and assembling even preliminary data can be high, technological solutions that lower these barriers are desirable and emerging.

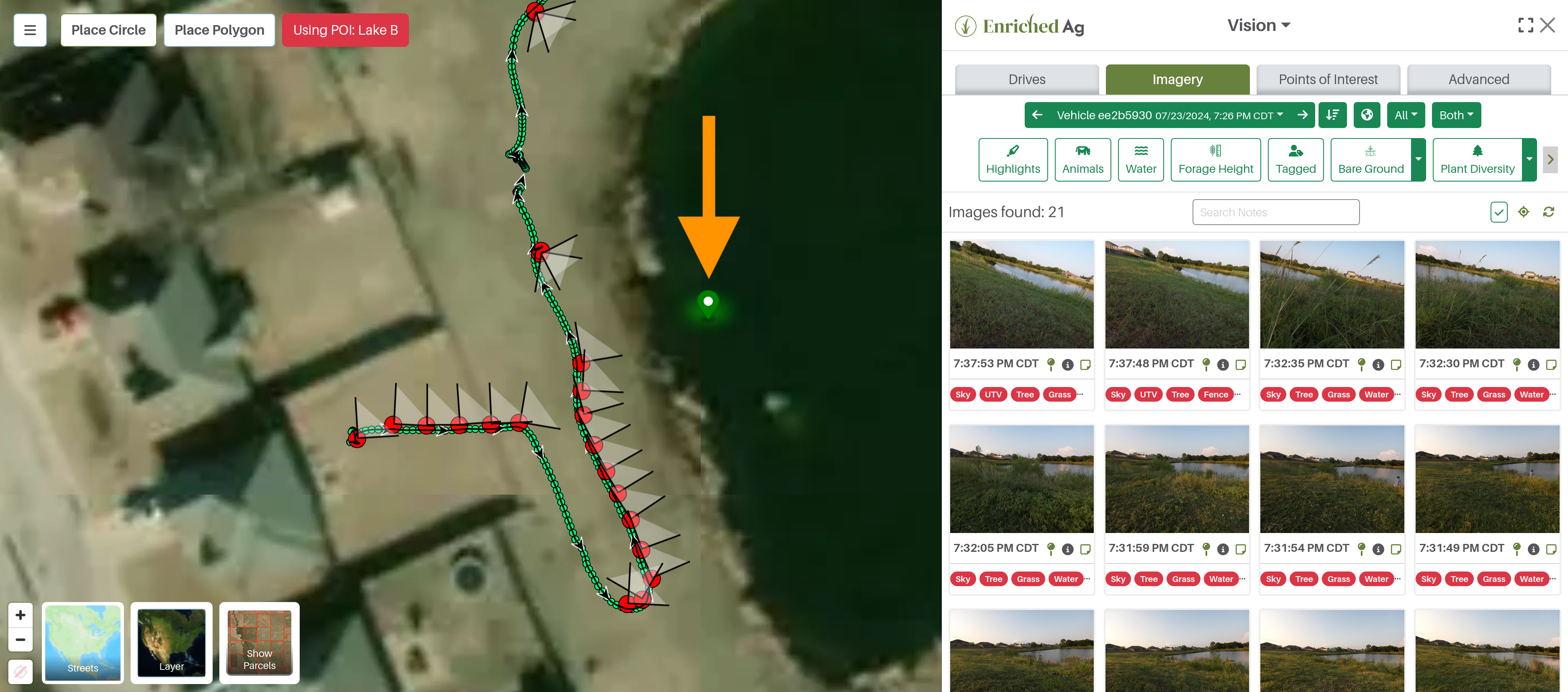

Harnessing the power of remote sensing and large-scale data aggregation can lead to increasingly reliable data sources and the creation of credible baselining. It is likely that first movers in the data collection phase will have a decided advantage, so long as low-cost initial acquisition strategies can be found.

Systems that can leverage remote sensing, aggregate existing and accessible data streams, and combine these with local ‘ground truth’ samples to generate ever-improving precision will lower the barrier to entry. It is also likely that the data used to create these baselines for a property can also contribute to management decision support in other aspects of land management, especially for more extensive systems like grazing where data limitations are often encountered.

Such systems are likely to lead to improved prediction of response to management action, further improving decision-making. Better prediction of responses to combinations of unique site parameters and management strategies will enable managers to determine costs and benefits and define strategies effectively.

The ‘first-mover’ advantage for baseline data collection will be amplified when combined with predictive capabilities. While the ‘hardware’ element of technology development in these areas is attractive, with the possibility of sensor-based measurement, more automated sampling, and faster, lower-cost sample analysis as important elements of the system, it is likely that the ‘soft’ side of data assembly, analysis, and modeling that can fully utilize the data streams are ultimately the most valuable.

Technologies that resolve some of the structural/systemic issues are also important. As the pace of technical development in data acquisition leads to the generation of more supply, the capacity of technical providers to identify, store, transfer and track generated credits will open the marketplace and reduce the friction of transactions while increasing reliability.

Similar to banking systems today, the ability to secure and manage transactions in natural capital markets is essential to realizing the full potential of these markets and increasing the confidence of market participants. These increases in market efficiency will also increase the efficiency of price discovery, allowing value to be realized more clearly than in current ‘one-off’ or bespoke trading arrangements.

Now or later?

Of course, land managers must then answer the question of ‘now or later?’.

While the market in voluntary carbon credit exchange is still nascent, the example from more regulated markets suggests that future values can be increased if the barriers associated with reliability and verification can be addressed. This might encourage managers to begin to accumulate baseline data (and thus gain first-mover advantage) and wait for price escalation on increasing demand development.

Of course, if those challenges can be addressed simultaneously with solutions that increase the ability of land managers to develop and deliver supply, the total market size will grow rapidly, potentially outpacing demand.

This outlook might encourage less speculative managers to try to secure sales in the shorter term, taking the ‘bird in the hand’ approach to marketing. Ultimately, in relatively uncertain situations, each manager will have to determine their capacity and appetite for risk, both production risk and price risk.

The wisest course may be to initiate some form of data collection and seek to develop a foundation, making incremental commitments over time as confidence, capacity, and conditions develop. Most importantly, developing a mindset and commitment to data collection and applying it to a holistic set of management decisions is likely to yield value, with carbon and other natural capital opportunities representing only one value stream.

— Jason E. Sawyer, Ph.D. , Chief Science Officer, East Foundation